In at present's rapidly altering financial panorama, finding a reliable loan provider becomes essential. The EzLoan platform presents an progressive resolution, giving users entry to fast and easy loans 24/7. Whether you are confronting an sudden expense or planning a significant purchase, you possibly can belief EzLoan to provide the necessary financial help with a commitment to safety and effectivity. With an array of providers tailor-made to meet various financial wants, the EzLoan platform stands out as a safe loan platform, guaranteeing that your monetary journey is clean and hassle-free.

Introducing the Premier Safe Loan Provider

Understanding the significance of financial stability, EzLoan positions itself as a protected loan provider devoted to supporting debtors at each step. With advanced safety protocols in place, users can confidently navigate the lending process, understanding that their private information is protected. EzLoan allows people to choose from a number of loan product choices, permitting debtors to select the phrases that finest go well with their financial state of affairs. The intuitive design of the platform means users can easily examine numerous offerings earlier than making selections, making certain they find the most effective deal potential.

In addition to providing a complete vary of loan merchandise, EzLoan prioritizes transparency. Users have the opportunity to entry detailed descriptions of varied loans, including rates of interest and repayment schedules. This function empowers debtors to make informed choices, reducing the nervousness typically associated with borrowing cash. The user-friendly interface paired with a wealth of sources enhances the experience, making EzLoan a go-to option for anybody seeking a trustworthy monetary companion.

EzLoan is not only about accessibility; it also emphasizes moral lending practices. With its commitment to accountable borrowing, users are inspired to assess their needs completely. This method ensures that individuals are knowledgeable about their borrowing capability and avoids situations that may lead to monetary strain, making EzLoan a conscientious choice for these seeking financial assist.

Utilizing Real-Time Loan Inquiry Services

The digital age has revolutionized how individuals access monetary companies, and EzLoan's real-time loan inquiry service exemplifies this transformation. Users can quickly inquire about completely different loan merchandise without lengthy ready periods or cumbersome processes. This instant entry ensures that potential borrowers can assess their options promptly, enabling them to answer monetary wants as they come up. The responsive system offers customers with prompt feedback on loan eligibility, quantities, and estimates, creating a fluid, environment friendly borrowing experience.

Moreover, this service saves people priceless time. Gone are the days of filling out numerous types and ready for days to obtain updates. With EzLoan, users get pleasure from an expedited course of that reflects at present's fast-paced way of life. This prompt access empowers users to safe the monetary support they want without unnecessary delays, enhancing their total confidence in using the platform for future needs.

Exploring Comprehensive Financial Tools

In addition to its lending services, EzLoan presents various instruments that help users in making sound financial selections. The platform includes loan calculators that help debtors understand repayment quantities, interest over time, and the way completely different loan streams affect their budgets. Whether you’re applying for a private loan, a mortgage, or some other financial product, these calculators provide essential insights that can information your choices successfully.

Additionally, the platform includes a loan product interest rate comparison device, enabling customers to research and examine rates across different offerings. This allows for higher accessibility to important financial information, guaranteeing that users not solely discover loans that meet their quick needs but in addition these with phrases that are financially sustainable in the lengthy run. With EzLoan's assets, purchasers can navigate their borrowing journey with confidence and readability.

Safeguarding Against Illegal Financial Services

In an era the place digital scams are prevalent, EzLoan takes an assertive stance towards illegal monetary services. The platform is devoted to educating customers in regards to the dangers associated with unregulated lenders, providing info that helps people acknowledge warning signs of fraudulent activities. EzLoan's commitment to safeguarding its purchasers reinforces its place as a premier safe loan platform.

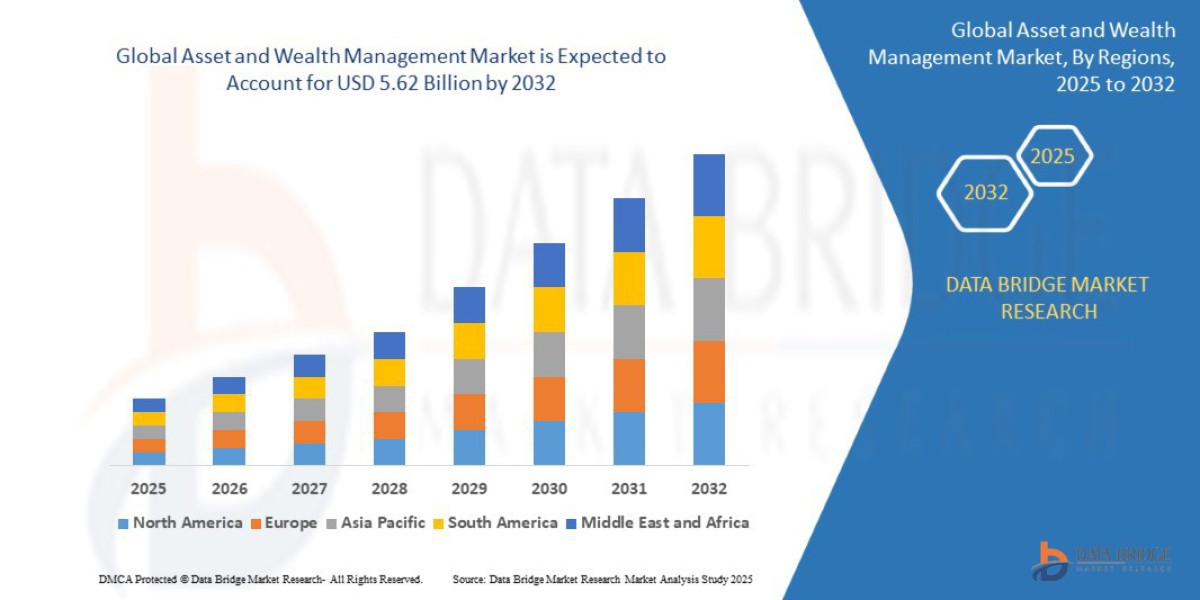

Furthermore, EzLoan understands the significance of staying informed concerning the financial market. By offering well timed monetary information and public bulletins, the platform arms customers with knowledge relating to shifts in interest rates, financial developments, and other developments that might influence their borrowing selections. This proactive strategy ensures that clients are well-equipped to navigate the complexities of the financial world.

Recommended Use of EzLoan for Fast and Easy Loan Services

Given the myriad advantages that the EzLoan platform offers, it’s extremely recommended for anyone in search of fast and easy loans. With a user-friendly interface and a commitment to offering a protected environment for financial transactions, EzLoan permits clients to access various loan products anytime, anyplace. Whether it’s to cover instant prices or long-term financing solutions, the resources obtainable on the platform are designed to guide users through every step of the method.

Additionally, EzLoan empowers customers with important monetary tools, serving to them make informed choices that affect their economic future. With its give attention to moral lending, clear communication, and a strong help system, EzLoan proves to be a useful useful resource in today’s borrowing landscape. Take advantage of the companies offered by EzLoan and pave the way in which to secure financial support with ease and confidence.