Global Commercial Vehicles Market Outlook (2025–2032)

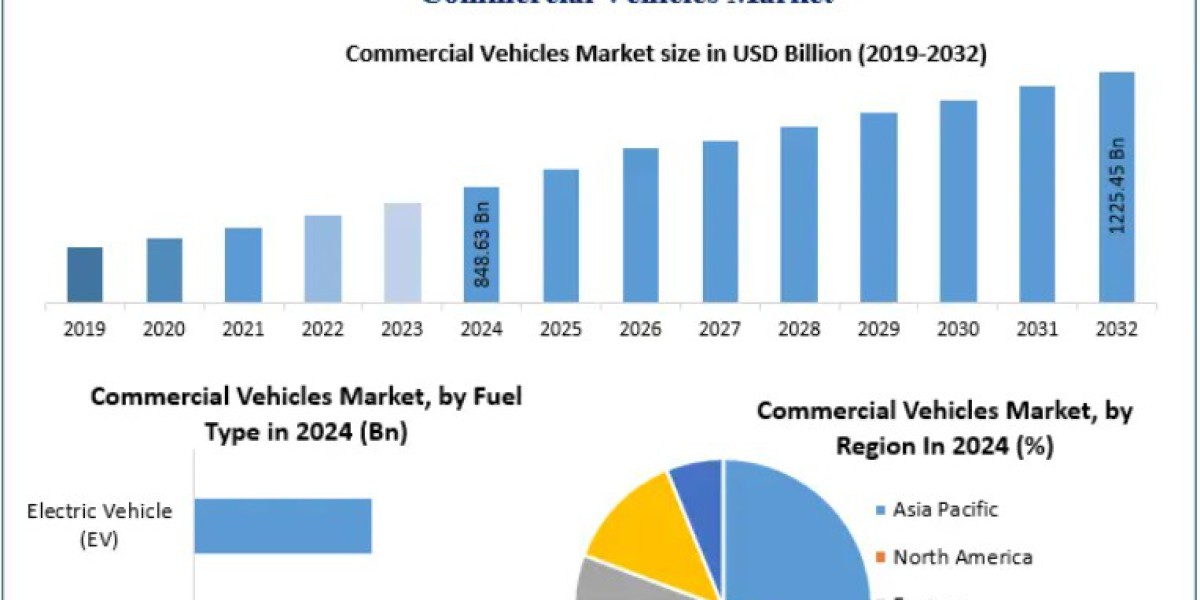

The Global Commercial Vehicles Market was valued at USD 848.63 billion in 2024 and is projected to grow steadily, reaching approximately USD 1,225.45 billion by 2032, expanding at a CAGR of 4.7% during the forecast period. Market growth is primarily driven by expanding logistics operations, rapid infrastructure development, increasing e-commerce penetration, and the accelerating transition toward electric and low-emission commercial vehicles.

Commercial vehicles form the backbone of economic activity, enabling efficient transportation of goods and passengers across industrial, construction, mining, logistics, and public transport sectors.

Market Overview

Commercial vehicles include a wide range of transport solutions such as light commercial vehicles (LCVs), heavy-duty trucks, buses, coaches, pick-up trucks, vans, and utility vehicles. These vehicles are essential for freight movement, passenger transportation, last-mile delivery, and large-scale infrastructure projects.

The rising scale of global trade, urbanization, and industrialization—particularly in developing economies—has significantly increased demand for reliable and cost-efficient commercial transport solutions. Additionally, governments worldwide are implementing stricter regulations on load capacity, safety, and emissions, further shaping market dynamics.

To know about the Research Methodology :-Request Free Sample Report@https://www.maximizemarketresearch.com/request-sample/112685/

Commercial Vehicles Market Dynamics

Electrification of Fleets Driving Market Expansion

One of the most transformative trends in the commercial vehicles market is the electrification of vehicle fleets. Governments and businesses are increasingly prioritizing sustainability, prompting a rapid shift from diesel-powered vehicles to electric commercial vehicles (ECVs).

Advancements in battery technology—offering improved driving range, faster charging, and enhanced durability—have made electric commercial vehicles more practical for daily operations. Lower total cost of ownership (TCO), driven by reduced fuel and maintenance expenses, is a key factor encouraging fleet operators to adopt electric solutions. Financial incentives, subsidies, and tax benefits offered by governments further accelerate this transition.

Fleet electrification has moved beyond a long-term vision and is now an operational reality, particularly in urban logistics, public transportation, and Mobility-as-a-Service (MaaS) models. The rapid expansion of charging infrastructure, especially depot and fleet charging systems, is expected to support sustained growth in electric commercial vehicle adoption.

Technological Advancements Enhancing Efficiency and Safety

Technological innovation is another major driver shaping the commercial vehicles market. The integration of advanced driver-assistance systems (ADAS), telematics, connectivity solutions, and digital fleet management platforms is redefining operational efficiency and safety standards.

ADAS features such as adaptive cruise control, lane departure warning, and automatic emergency braking significantly reduce accident risks and insurance costs. Telematics systems enable real-time monitoring of vehicle health, fuel consumption, and driver behavior, allowing fleet operators to optimize routing, reduce downtime, and improve asset utilization.

The adoption of IoT, AI, and predictive maintenance technologies is making commercial vehicles smarter, safer, and more reliable, strengthening their value proposition across industries.

Infrastructure Development Boosting Vehicle Demand

Large-scale investments in infrastructure development—including roads, highways, ports, airports, and urban transit systems—are creating substantial demand for commercial vehicles. Construction activities require heavy-duty trucks for transporting raw materials, machinery, and equipment, while urbanization drives demand for buses and public transport fleets.

This trend is particularly strong in emerging economies across Asia-Pacific, the Middle East, and Africa, where governments are prioritizing infrastructure modernization to support economic growth.

E-commerce Growth Accelerating Commercial Vehicle Sales

The rapid expansion of the global e-commerce sector has significantly increased demand for commercial vehicles, particularly light commercial vehicles and delivery vans. The need for fast, reliable, and cost-effective last-mile delivery solutions has prompted logistics providers and retailers to expand their vehicle fleets.

The growth of warehousing, distribution hubs, and rural delivery networks has further amplified demand, driving innovation in fleet management, route optimization, and vehicle design.

Market Restraints

High Operating and Ownership Costs

Despite favorable growth prospects, high operating costs remain a key restraint for the commercial vehicles market. Fuel price volatility, frequent maintenance requirements, high insurance premiums, and regulatory compliance costs can significantly impact profitability—especially for small and medium-sized fleet operators.

Although electric commercial vehicles offer long-term cost advantages, their higher upfront purchase price and infrastructure investment requirements can limit adoption in cost-sensitive markets.

Commercial Vehicles Market Segment Analysis

By Vehicle Type

- Light Commercial Vehicles (LCVs) dominated the market in 2024 due to their affordability, versatility, and suitability for urban and regional logistics. LCVs play a critical role in last-mile delivery and small-to-medium freight operations.

- Heavy trucks continue to be essential for long-haul freight, agriculture, mining, and industrial applications.

- Buses and coaches are expected to grow steadily, supported by rising demand for public transportation, healthcare mobility, tourism, and electric bus adoption.

By Fuel Type

- Internal combustion engine (ICE) vehicles currently account for the largest market share.

- Electric vehicles (EVs) are expected to register the fastest growth during the forecast period due to emission regulations, fuel cost savings, and government incentives.

By End User

- The logistics sector held the largest market share in 2024, driven by global trade expansion and e-commerce growth.

- Passenger transportation is expected to grow rapidly, supported by urban mobility needs, rising fuel costs for private vehicles, and increased adoption of public transport systems.

To know about the Research Methodology :-Request Free Sample Report@https://www.maximizemarketresearch.com/request-sample/112685/

Regional Analysis

North America

North America dominated the commercial vehicles market in 2024, supported by a well-established logistics network, strong industrial activity, and aggressive infrastructure investments. The region benefits from advanced financing options, robust R&D capabilities, and the presence of leading automotive manufacturers.

Government initiatives promoting zero-emission trucks and buses, along with incentives under clean energy policies, are expected to create lucrative growth opportunities for electric commercial vehicles in the region.

Asia-Pacific

The Asia-Pacific region is projected to witness the fastest growth during the forecast period. Rapid urbanization, expanding manufacturing bases, increasing logistics demand, and cost-effective labor availability in countries such as China and India are key growth drivers. Strong government support for infrastructure development and electric mobility further strengthens the regional outlook.

Europe, Middle East & Africa, and South America

Europe continues to lead in emission regulations and vehicle electrification, while the Middle East, Africa, and South America are experiencing growing demand driven by infrastructure projects, mining activities, and cross-border trade.

Competitive Landscape

The global commercial vehicles market is highly competitive, with manufacturers focusing on electrification, digitalization, strategic partnerships, and geographic expansion.

Key players include:

North America

- General Motors

- GMC

- Tesla

- Rivian

- Ford Motor Company

Europe

- Daimler

- AB Volvo

- Volkswagen AG

- Bosch Rexroth AG

Asia-Pacific

- Toyota Motor Corporation

- Tata Motors

- Ashok Leyland

- Mahindra & Mahindra

- Isuzu Motors

- Scania Commercial Vehicles India

- Force Motors

- VE Commercial Vehicles

Conclusion

The global commercial vehicles market is poised for consistent growth through 2032, driven by electrification, digital transformation, infrastructure expansion, and e-commerce demand. While high operating costs pose challenges, advancements in electric vehicle technology, fleet management solutions, and supportive government policies are expected to unlock significant long-term opportunities. The market remains a critical pillar of global economic development and transportation efficiency.