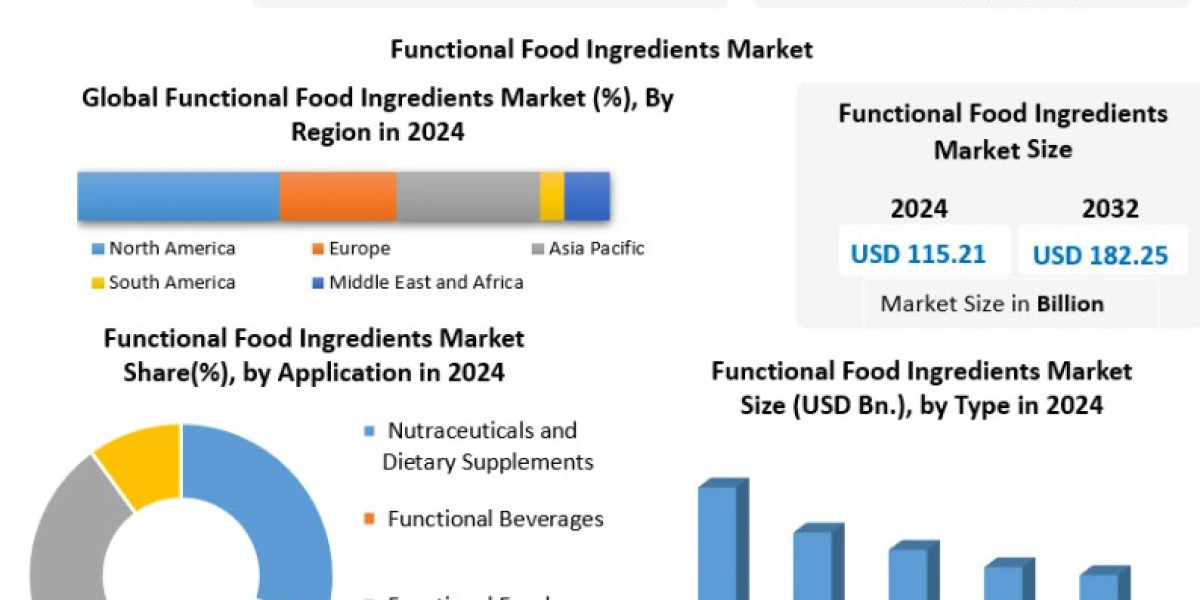

The Global Functional Food Ingredients Market is firmly positioned as a high-growth, health-driven industry, valued at USD 115.21 Bn in 2024 and projected to reach USD 182.25 Bn by 2032, expanding at a CAGR of 5.9%. This growth reflects a structural shift in global food consumption—from basic nutrition toward preventive, personalized, and functional nutrition.

Functional ingredients are no longer niche additives; they are becoming core formulation components across everyday food and beverage categories.

Feel free to request a complimentary sample copy or view a summary of the report: https://www.maximizemarketresearch.com/request-sample/29344/

Market Structure & Momentum

1. Demand-Side Transformation (Key Growth Engine)

The market’s growth is fundamentally consumer-led:

Rising chronic diseases (diabetes, cardiovascular disorders, obesity)

Growing aging population seeking preventive nutrition

Increasing nutrition literacy and trust in science-backed ingredients

Preference for daily-consumption formats (cereals, dairy, beverages)

Functional food ingredients bridge the gap between pharmaceutical prevention and conventional diets, making them highly scalable.

The report effectively links lifestyle diseases with functional ingredient adoption, reinforcing long-term demand sustainability.

Feel free to request a complimentary sample copy or view a summary of the report: https://www.maximizemarketresearch.com/request-sample/29344/

Segment-Level Insights

By Type: Probiotics & Prebiotics Dominate

This segment leads due to strong association with gut health, immunity, and mental wellness

Backed by:

Clinical research

Fermented food innovation

Expansion into supplements and beverages

The microbiome narrative is becoming a mainstream health pillar, not a trend

Strategic Insight:

Probiotics/prebiotics command premium pricing, making them margin-positive for manufacturers.

By Application: Functional Foods Lead the Market

Functional foods outperform supplements and medical nutrition because they:

Fit seamlessly into daily diets

Reduce “pill fatigue”

Offer clean-label and indulgence + health combinations

Categories like dairy, cereals, snacks, and bakery act as mass-market delivery systems for functional ingredients.

Growth Catalyst: Retail penetration + product innovation (immunity snacks, fortified staples)

Feel free to request a complimentary sample copy or view a summary of the report: https://www.maximizemarketresearch.com/request-sample/29344/

Regional Analysis: Power Shift Underway

North America: Innovation & Regulation Leader

Strong R&D ecosystem

Clear regulatory frameworks (FDA, GRAS)

High consumer willingness to pay for functional benefits

Mature but innovation-driven market

Asia-Pacific: Fastest Growth Region

Expanding middle class

Urbanization and dietary shifts

Government nutrition initiatives

Strong adoption in India, China, Japan, ASEAN

Key Insight:

While North America dominates today, Asia-Pacific will be the primary volume growth driver through 2032.

Competitive Landscape Assessment

The market is highly consolidated but innovation-intensive.

Strategic Patterns Among Leaders:

Heavy R&D investment

Shift toward plant-based, clean-label, and sustainable sourcing

Regional customization of formulations

Expansion into personalized nutrition platforms

Key players such as ADM, Kerry Group, DSM, Cargill, Ajinomoto, and IFF (DuPont) are competing less on scale and more on:

Scientific validation

Ingredient functionality

Sustainability credentials

Key Market Constraints (Reality Check)

Despite strong momentum, the report highlights real challenges:

Regulatory complexity across regions

Restricted health claims limiting marketing flexibility

Rising ingredient costs

Longer product development cycles

These factors raise barriers to entry, favoring established players with regulatory expertise.

Strategic Outlook

What This Market Signals:

Functional food ingredients are becoming essential, not optional

Growth is durable due to alignment with healthcare, wellness, and lifestyle shifts

Innovation, compliance, and personalization will define winners

Who Benefits Most:

Ingredient suppliers with clinical backing

Brands integrating functionality into everyday foods

Companies expanding in Asia-Pacific markets